Budget planning chart download#

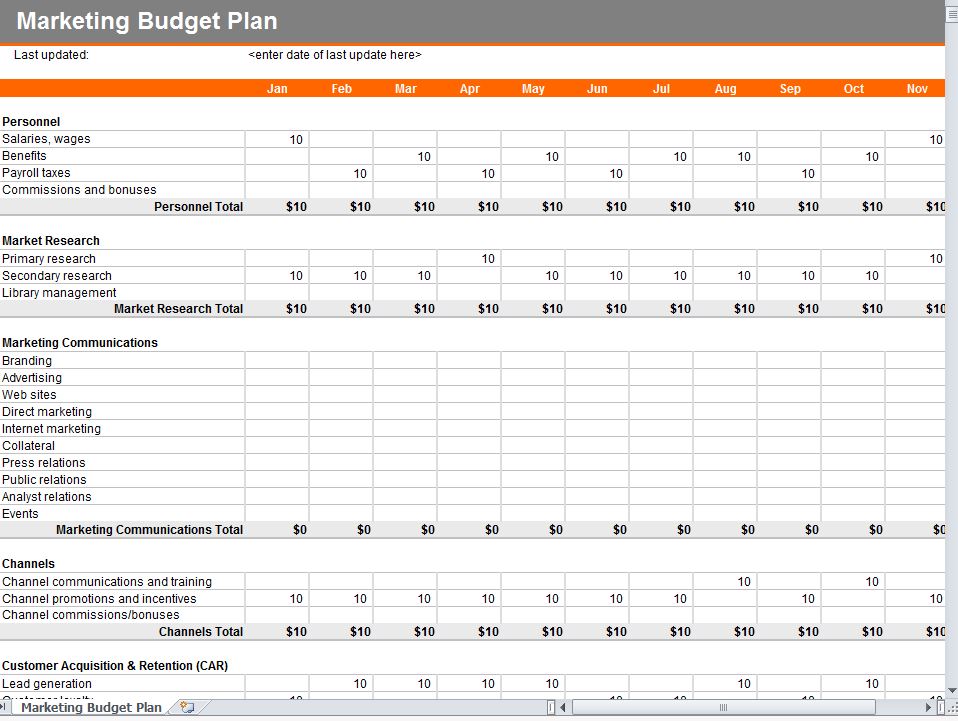

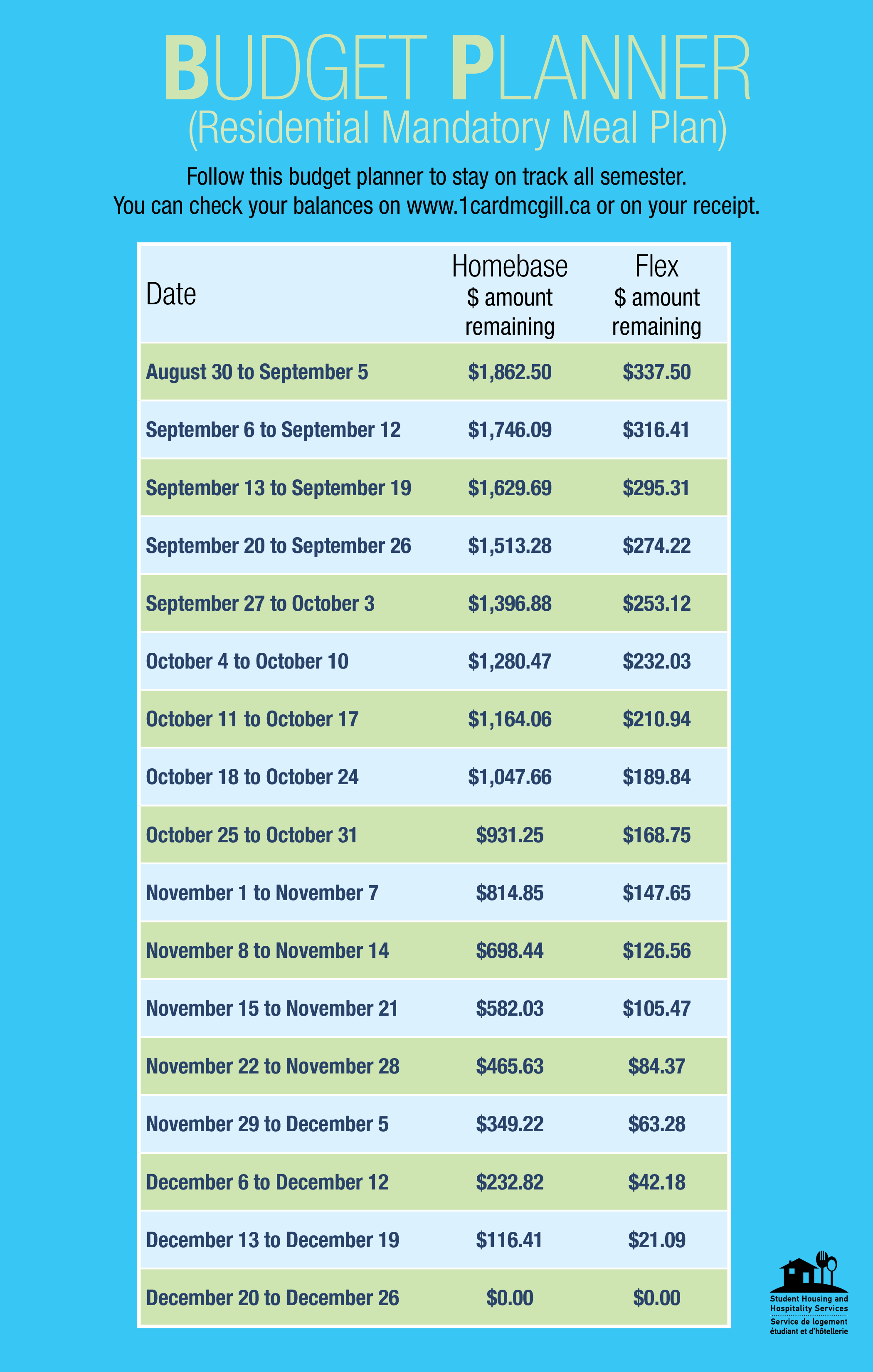

Spending Tracker – Download and save this worksheet to your computer to help you keep track of your expenses each month.Some tools to help with tracking spending include: You’ll learn a lot more about your spending habits and what expenses are most important to you. Once you know what you’d like your budget to be, keep track of your spending.

Budget planning chart how to#

Simple Steps to a Spending Plan – Follow this step-by-step guide to learn how to create a spending plan.Creating a Spending Plan Video – Watch this UW Mindful Money Moment video on why and how to create your own spending plan.To learn how to make and follow a spending plan, check out the resources below. It is never perfect, but if you keep working at it and improving it, you’ll get to a place where it’s good enough. Try it, then tweak it to make improvements and try it again. Here’s what students in a group spending class said.Ĭreating a spending plan is a process. Goals – money set aside for emergencies, replacing your vehicle, a family trip, medical co-pays, paying off credit card debt, retirement, education, or other future expenses.Money going out – regular monthly bills, like housing, groceries, utilities, clothing, childcare, car payment, credit cards, doctor bills – well, you get the idea.Money coming in – paychecks, tips, loans, scholarships, child support, and other cash benefits.True, automatic transfers ($50 per pay-check for example) are a good way to save for future expenses like car repairs and insurance bills. A spending plan should include all of your money coming in, money going out, and money put towards savings. Click on the blue box to find the correct answer. Answer “ true or false” to the three statements below. …describe the benefits of tracking spending.Ĭomplete the following pre-learning check to test your knowledge.…determine how much you need to save regularly for irregular and/or unexpected expenses like car repairs and insurance payments.…construct your own spending plan that includes all your expenses and income.By the end of this module, you will be able to… This module takes about 30 minutes to complete. It can help you make sure you have money to pay bills on time, even when your bills and income change each month. A good spending plan can help you stop “spending leaks” in other words, it can keep you from spending money without thinking. A spending plan (also called a budget) is simply a plan you create to help you meet expenses and spend money the way you want to spend it.

0 kommentar(er)

0 kommentar(er)